Federal tax bill hits hardest in District of Columbia

<p>(AP) - Americans are preparing to meet the Tuesday deadline for filing their federal income tax returns. Data from the IRS and the Census Bureau show that three states - Delaware, Minnesota and Massachusetts - on average paid the most per person in federal income, payroll and estate taxes in 2016. The three states that paid the least per person are New Mexico, Mississippi and, at No. 50, West Virginia. But the residents of the District of Columbia paid more per person than those in...</p>

News 12 Staff

•

Apr 17, 2017, 1:58 PM

•

Updated 2,558 days ago

Share:

More Stories

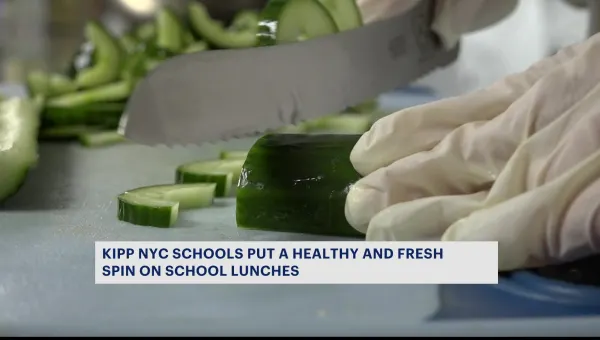

0:23

Ford recalls over 456,000 Bronco Sport and Maverick cars due to loss of drive power risk

15h ago2:50

be Well: Celebrate in style with these decorating tips

yesterday3:49

be Well: Best beauty products that are also great for the environment

2ds ago1:47

Food labels can sometimes be misleading. Kane In Your Corner explains what to look out for.

3ds ago1:37

The Real Deal: How to save the next time you dine out

6ds ago1:40

EPA imposes first-ever national drinking water limits on toxic PFAS

8ds ago0:23

Ford recalls over 456,000 Bronco Sport and Maverick cars due to loss of drive power risk

15h ago2:50

be Well: Celebrate in style with these decorating tips

yesterday3:49

be Well: Best beauty products that are also great for the environment

2ds ago1:47

Food labels can sometimes be misleading. Kane In Your Corner explains what to look out for.

3ds ago1:37

The Real Deal: How to save the next time you dine out

6ds ago1:40

EPA imposes first-ever national drinking water limits on toxic PFAS

8ds ago

(AP) - Americans are preparing to meet the Tuesday deadline for filing their federal income tax returns.

Data from the IRS and the Census Bureau show that three states - Delaware, Minnesota and Massachusetts - on average paid the most per person in federal income, payroll and estate taxes in 2016.

The three states that paid the least per person are New Mexico, Mississippi and, at No. 50, West Virginia.

But the residents of the District of Columbia paid more per person than those in any of the states - more than double, in fact.

Why do Washington, D.C., residents pay so much more? A fellow at the Tax Policy Center, Roberton Williams, says that's where the money is, noting a lot of high-income people live in the nation's capital.

(Copyright 2017 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.)

4/17/2017 3:18:07 AM (GMT -4:00)