More Stories

Summer is officially here and that means many people are probably already

planning for some much-needed vacation time.

But did you know

the airlines’ frequent flyer credit cards are not always the best way to land

free plane tickets?

Turn to Tara has

some tips on how to maximize reward programs.

MORE: Turn to Tara

Cindy Greenstein,

The Points Mom, has been addicted to earning points and miles.

Since the 90s, the

Chappaqua mom of three, has turned her expertise with rewards programs into a

career, helping vacation-craving families snag five-figure trips all across the

globe - simply by using the right credit cards to pay for household expenses.

Greenstein says Capitol One's

newest credit card debuted with a 100,000-mile bonus, and offers two miles for

every dollar you spend, so she uses it on everything except her dining and

grocery expenses.

The American Express Gold Card

offers four times Amex points on restaurants and grocery stores.

And YES parents - Greenstein

says to go ahead and get your children involved. Give them credit cards so they

can contribute to the family of points in miles.

The Real Deal: Best credit cards for travel savings

So you've earned the points -

now what?

Common errors that people can

make when using points miles is they may not compare redeeming points versus

the websites royalty program versus transferring miles or points.

Here's an example:

A $500 ticket on Delta might

cost 50,000 American Express points, but on Delta's rewards site it may cost

40,000 miles. So instead of redeeming the points on American Express,

Greenstein says to just transfer 40,000 of those points to the Delta rewards

program.

Greenstein also says it's a

mistake to redeem points on Amazon. And when it comes to new cards, be sure to

hit the minimum charge amount within the given time period, or you risk

canceling your sign-up.

Got a problem? You should Turn to Tara. HERE'S HOW.

More from News 12

2:34

Guide: Safety tips to help prevent home burglaries

2:19

Guide: Safety measures to help prevent fires and how to escape one

2:40

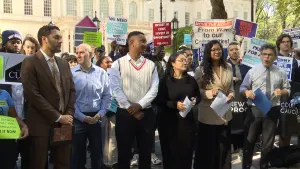

Mayor's budget cuts: A controversial solution amidst immigration crisis

2:07

Tips on how to avoid confrontation with sharks while swimming in the ocean

2:33

5 tips to prevent mosquito bites and getting sick from viruses

2:39