More from News 12

1:58

DCWP accuses R.G. Ortiz Funeral Homes of exploiting grieving families in lawsuit

1:30

Exclusive video: 4 suspects wanted for gunpoint robbery in Morrisania

2:08

Summerlike temps in the 80s for NYC; tracking stray showers throughout the week

1:56

New electric school buses to replace full NYC diesel fleet in by 2035

1:38

Residents out and about on day of sunshine

0:41

Bronx DA investigating allegations of dogs attacking animals

0:59

City of Yes for Housing Opportunity hosted by Mayor Adams at City Hall

1:29

Cardinal Spellman baseball player receives full scholarship

1:51

Heading to a Bronx beach today? Here's why you need to stay out of the water

0:24

NYPD: Man wanted for punching victim, stealing his wallet in Morris Heights

1:51

Fordham University graduate student leads new project recalling Bronx's Jewish history

1:30

Bronx residents enjoy spring weather at Orchard Beach

0:26

NYPD: 48-year-old man stabbed on Gun Hill Road; suspect in custody

2:19

City Island Nautical Museum opens for the season with 3 new exhibits

0:29

FDNY: Man rescued after falling in a pit in Mott Haven

0:52

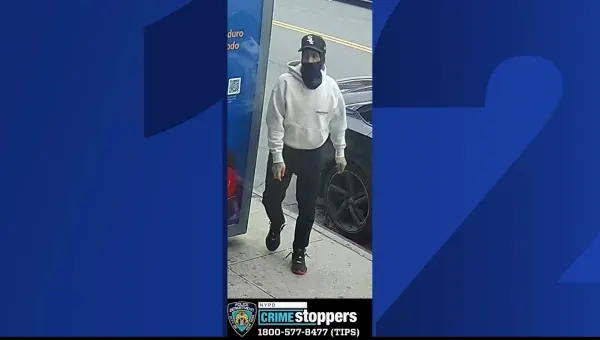

NYPD: Suspect wanted for multiple robberies in the Bronx

Rangers finish off sweep of the Capitals, move on to the 2nd round of the NHL playoffs

1:28

Brooklyn residents enjoy beautiful day at Coney Island boardwalk

0:31

NYPD: Suspect wanted for assaulting woman on Jerome Avenue

0:30