Green Acres Mall's $100 million renovation comes with tax deal

Construction is underway at the mall. Dozens of new restaurants and stores are expected to open over two years.

Share:

More Stories

1:45

Preserving History: Community pushes to preserve historic African burial ground

in 1,248m

Man fatally stabbed at NYCHA Edenwald Houses

31m ago2:06

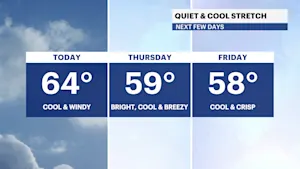

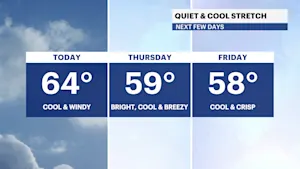

Windy Wednesday with some sunshine for Brooklyn

2h ago1:30

Impact of ICE raids on vendors in Chinatown felt across Bronx communities

2h ago0:26

7 injured, including 1 firefighter, after fire in Melrose building

2h ago0:29

Mother arrested, charged after baby abandoned at Penn Station

6h ago1:45

Preserving History: Community pushes to preserve historic African burial ground

in 1,248m

Man fatally stabbed at NYCHA Edenwald Houses

31m ago2:06

Windy Wednesday with some sunshine for Brooklyn

2h ago1:30

Impact of ICE raids on vendors in Chinatown felt across Bronx communities

2h ago0:26

7 injured, including 1 firefighter, after fire in Melrose building

2h ago0:29

Mother arrested, charged after baby abandoned at Penn Station

6h agoAn extended payment in lieu of taxes agreement will save the Green Acres Mall money, but local schools are concerned some burden shifts to homeowners.

Construction is underway at the mall. Dozens of new restaurants and stores are expected to open over two years.

Ten years ago, the Hempstead IDA granted Macerich, the company that owns the mall, a 10-year agreement, where they make payments in lieu of taxes, also called a PILOT program, saving the mall millions in taxes.

According to the Hempstead IDA, last year Macerich paid $14.5 million to Valley Stream schools, Valley Stream village, the Town of Hempstead and Nassau County.

When Macerich announced last year its going to spend over $100 million to redevelop the mall they asked for another PILOT deal.

The Hempstead IDA agreed to extend the PILOT agreement by five years resulting in more savings for Macerich.

These tax break have many homeowners and the surrounding school districts worried the tax burden is being shifted to them.

The four Valley Stream school districts filed a lawsuit trying to block the extension, claiming the tax break was being subsidized by homeowners.

A judge dismissed the lawsuit in April.

The mall responded to taxpayer concerns saying they are committed to helping the community, like the backpack drive it will hold at the end of August.

"We run several events monthly incorporating the community from the little league softball team to the back to school event," said Richard Madramuthu, with Macerich.